kern county property tax rate

Here you will find answers to frequently asked questions and the most. Search for Recorded Documents or Maps.

Which established the method of allocating property taxes for fiscal year FY 1979-80 base year and subsequent fiscal years.

. The property tax deadline is looming. 1788 rows Kern. Our online access to Kern County public records data is the most convenient way to look up Tax Assessor data property characteristics deeds permits fictitious business names and more.

Kern County Assessor-Recorder County Terms of Sale - March 2022 Kern County General Tax Sale Information Kern County Tax Sale Brochure List of Title Companies Tax Rate Areas Zoning Departments Zoning Information News and Announcements. File an Exemption or Exclusion. No CDs to load no concerns about dated information.

Added 13 Sep 2018. Property Taxes in Kern County. The first installment is due on 1st November with a payment deadline on 10th December.

The median property tax on a 21710000 house is 173680 in Kern County The median property tax on a 21710000 house is 160654 in California The median property tax on a 21710000 house is 227955 in the United States. Taxes become a lien on all real property on the first day of January at 1201 AM. Kern County to apportion and allocate property tax revenues for the period of July 1 2012 through June 30 2017.

Stay Connected with Kern County. November 29 2021 59 min. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of 080 of property value.

Find Property Assessment Data Maps. Kerr County Courthouse 700 Main Street Suite 124 Kerrville Texas 78028 Phone. Texas Secretary of State.

The second installment is due on 1st. Request a Value Review. County Kern Median Home Value 190600 Median Annual Property Tax Payment 1934 Average Effective Property Tax Rate 101.

Please enable cookies for this site. The first installment becomes due and payable on November 1 st each year and delinquent on December 10 th at 500 PM. If delinquent you will have to pay a 10 percent late fee and 10 delinquency fee.

If December 10th isnt on your calendar. This incorporates the base rate of 1 and additional local taxes which are usually about 025. 1115 Truxtun Avenue Bakersfield CA 93301-4639.

Auditor - Controller - County Clerk. Please select your browser below to view instructions. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

Property Taxes Kerr County Courthouse 700 Main Street Suite 124 Kerrville Texas 78028 Phone. Tune in as Laurie interviews Jordan Kaufman Treasurer-Tax Collector of the County of Kern about the upcoming property tax deadline. Property and Tax payment Records.

No one likes to pay taxes but its something you cant avoid. Secured tax bills are paid in two installments. Cookies need to be enabled to alert you of status changes on this website.

You can pay in person at the Treasurer-Tax Collectors Office at 115. The Kern County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. Access vital information from any internet.

The Kern County Treasurer and Tax Collector Jordan Kaufman is reminding Kern residents that if their second installment of property tax is not paid by 5 pm. Purchase a Birth Death or Marriage Certificate. California Property Tax Rates.

Kern County real property taxes are due by 5 pm. It will be delinquent. 2001-2002 Annual Property Tax Rate Book.

To avoid a 10 late penalty property tax payments must be submitted or postmarked on or before the due date. Box 541004 Los Angeles CA 90054-1004. Connect from the office home road or around the world.

The release outlined three primary methods of payment. Change a Mailing Address. The methodology is commonly referred to as the AB 8 process or the AB 8.

This layer is a component of Dev Assessor mxd. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector. A 10 penalty is added if the payment is not made as of 500 pm.

File an Assessment Appeal. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. A bill may also contain special taxes debt services levies on voter-approved debt fees and assessments levied by the county or a city.

Get Information on Supplemental Assessments. See detailed property tax information from the sample report for 10804 Thunder Falls Ave Kern. Kern County CA Tax Rate Areas.

Payments may be made to the county tax collector or treasurer instead of the assessor. A property tax bill contains the property tax levied at a 1 tax rate pursuant to the requirement of Proposition 13. - A PROPERTY OWNER CANNOT BUY THEIR OWN PROPERTY AT A TAX SALE FOR LESS THAN THE TAXES.

Payments can be made on this website or mailed to our payment processing center at PO.

Realtors Let Worldgate Plaster And Stucco Help Coordinate An Eifs Inspection For Your Home Listing Http Www Stucco Home Inspection Home Inspector New Lenox

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Kern County Treasurer And Tax Collector

2 5 Acres For Sale In Victorville Ca Land Century Victorville Acres For Sale Land For Sale

New Homes For Sale In The Southern California 3 Broker Co Op And Frontier S Best Deals Brokers Welcome New Home Builders New Homes For Sale New Homes

Kern County Treasurer And Tax Collector

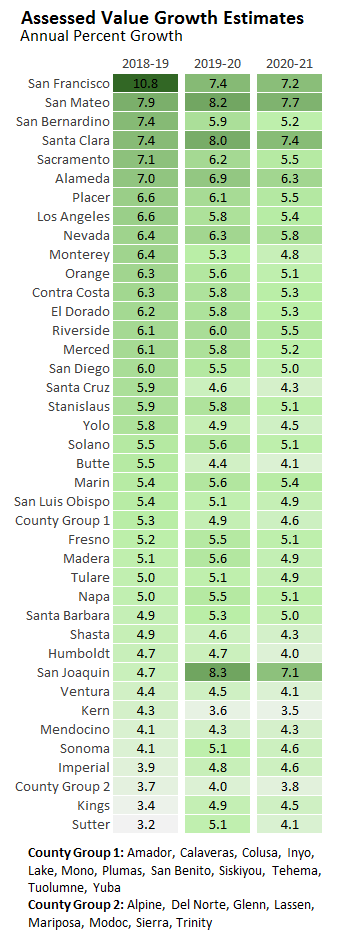

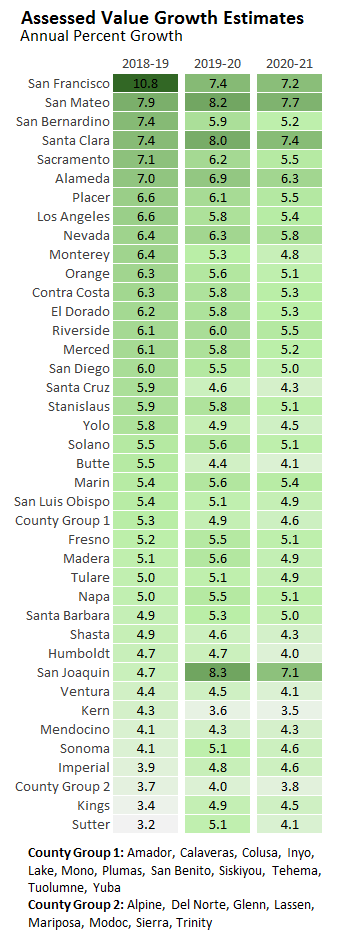

Fiscal Outlook Property Tax Estimates Exceed Budget Expectations Econtax Blog

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Ca Property Tax Search And Records Propertyshark

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

New Homes For Sale In Rosamond California Tour Our Well Crafted Homes In Rosamond Broker S Welcome Open House Invitation Open House New Homes For Sale

Kern County Ca Property Tax Search And Records Propertyshark

Property Tax By County Property Tax Calculator Rethority

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kern County Treasurer And Tax Collector